US Treasury yield was artificially low due to risk aversion from European crisis and Fed's intention to suppress the long end of the curve. The market has been pricing in 80-90% probability of more QE or OT from the Fed since Jan 2012.

However, after two rounds of LTRO liquidity injection, the banking stresses in the Eurozone have diminished. Especially with the orderly default of Greece, sentiment has been lifted across the globe. Combined with ongoing supportive growth data, particularly from the US, all risk assets are rallying. The policy-engineered Treasury yields may not be able to sustain the decouple from economic reality. A normalization repricing is currently taking place in the market. Yields across the curve seem to wake up and Fed fund futures is pricing a hike from Q4 2013, one year before the Fed's time frame.

The technical pictures of US Treasury yields show tentative signs of a break out to the upside. 10 year Note retraced back exactly towards the 61.8% Fibonacci retracement level. A touch below the 50% retracement level is the first sign of the end of the rebouce. Today, we witnessed the market's determined sell off of T note. A double top and a lower low formation with extreme volume surge suggest lower touch ahead. In terms of the 10 year yield, it has rallied above 200 day MA, then retested and now rally above it again. The momentum of RSI coupled with the positive MACD formation and upward sloping 50 day MA is shouting higher yield ahead. If it can close above 2.40% for a couple of days, it opens up the possibility of a test of the 2.90%--3.00% area, where it melt down last year.

Same picture can be found in the 30 year Bond, which has an even lower rebound force.

Moreover, gold and USD index both confirm higher yields ahead. Gold is close to test the low formed on Mar 22nd. If penetrated, a test of 1600 level is very likely, which will trigger 10 year yield to shoot up above 2.40%. USD is forming an inverted head and shoulder, with key level of 80 not far away. Close above 82 suggests powerful move up in USD index, which illustrate the currency market's expectation of higher US yields and better economic data.

April is historically the best month for Treasury yields. With such an artificial low yield and inter market pictures illustrated above, short Treasuries seem to be a safe bet in the short run.

Market Trend Blog -- 西鹤指路

Forecast market trends with detailed technical and fundamental analysis to help online traders. Stocks, rates, FX and commodities.

Tuesday, April 3, 2012

Monday, October 3, 2011

The synchronized global slump is under way

铜:上周跌幅超过25%。全球经济脉搏已经停摆。

金:上上周跌幅超过8%,为1983年后最大单周跌幅。后两个最深跌幅分别是2008年3月和2008年8月,Bear Stern和Lehman倒闭前夕。

美元:对G10和亚洲货币全面升值。问题是欧洲,可是上个月欧元跌幅只有6.4%, 而澳元和纽元跌幅在10%左右,这是对全球经济衰退的平仓动作。亚洲货币正在崩盘进行时中,包括人民币,NDF上上周首次出现贬值预期。

美债:10年期利率冲破2%,30年期利率跌破3%。更重要的是今天10s30s跌破100BPS关口,最终技术支撑在50BPS附近。这不仅将进一步压缩银行,养老金和保险公司收益率,而且个人消费倾向会不增反降,存款利率越低表明经济面越不确定,个人越不愿意消费,反而会增加存款。

股市:DAX指数已经两次试探5000点,第三次不一定顶的住。根据4浪和1浪不得重复原则,只要5000点跌破,全球经济将二次探底。DAX在作为全球金融市场领先指标上是很有指导意义的。同样,恒生指数方面,连续跌破重要支撑位,图形走势不像有任何到底迹象。SPX今天很有意义地跌破了1100关口,注意是收在1100之下,这将迎来一段迅速下串时间,下个支撑位在1070,再下面980。这次下跌会很相当快,请严密关注DAX 5000点关口。

商品货币:澳元,纽元和加元只是刚刚第一波下跌,对冲基金还未被迫强行平仓。一旦DAX跌破5000点,这对商品货币会是致命的一击,下跌幅度和速度会和2008相似。

The world is gripped by fears of a total meltdown of European fianacial system and the possibility of a renewed global recession. The synchronized global slump is under way.

金:上上周跌幅超过8%,为1983年后最大单周跌幅。后两个最深跌幅分别是2008年3月和2008年8月,Bear Stern和Lehman倒闭前夕。

美元:对G10和亚洲货币全面升值。问题是欧洲,可是上个月欧元跌幅只有6.4%, 而澳元和纽元跌幅在10%左右,这是对全球经济衰退的平仓动作。亚洲货币正在崩盘进行时中,包括人民币,NDF上上周首次出现贬值预期。

美债:10年期利率冲破2%,30年期利率跌破3%。更重要的是今天10s30s跌破100BPS关口,最终技术支撑在50BPS附近。这不仅将进一步压缩银行,养老金和保险公司收益率,而且个人消费倾向会不增反降,存款利率越低表明经济面越不确定,个人越不愿意消费,反而会增加存款。

股市:DAX指数已经两次试探5000点,第三次不一定顶的住。根据4浪和1浪不得重复原则,只要5000点跌破,全球经济将二次探底。DAX在作为全球金融市场领先指标上是很有指导意义的。同样,恒生指数方面,连续跌破重要支撑位,图形走势不像有任何到底迹象。SPX今天很有意义地跌破了1100关口,注意是收在1100之下,这将迎来一段迅速下串时间,下个支撑位在1070,再下面980。这次下跌会很相当快,请严密关注DAX 5000点关口。

商品货币:澳元,纽元和加元只是刚刚第一波下跌,对冲基金还未被迫强行平仓。一旦DAX跌破5000点,这对商品货币会是致命的一击,下跌幅度和速度会和2008相似。

The world is gripped by fears of a total meltdown of European fianacial system and the possibility of a renewed global recession. The synchronized global slump is under way.

Thursday, August 25, 2011

Mid term trend has changed

I did this last week but didn't have a chance to post. The big picture hasn't changed, guess it is still worthwhile to post.

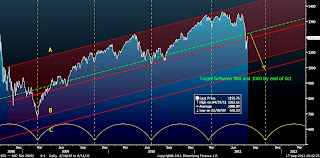

In the past month, SPX index broke two critical technical levels 1250 and 1150 decisively. This may have changed the mid term bullish trend that has been forming since March 2009. Given that 1250 is the most critical support level of 2011 and 1150 was the most critical support level of 2010, the penetration of both levels in a downward move try portraits a significant change of sentiment. Moreover, on the weekly chart, the purple line above has worked very well in determining up trend and down trend since 1995. Currently, the weekly close is below the purple line, which may as well signal a reverse of trend. In the past, a penetration from either above or below the line have sustained move afterwards. More importantly, MACD is losing momentum and MACD histogram dipped into negative tertiary, this is painting a bad future for the index.

SPX index has been trading in the channel formed through the top two redlines since 2008, not including the selling climax in early 2009. The current downward move slipped sharply below the channel lower line, and may be targeting the lower line of channel AB with March 2009 low connected. The current rebound is expected to be capped around the green midline of channel AB, which points to area around 1225. A rejection of move above 1225 would make 1040-1060 level as the first target, which points to the lower line of channel AB. A more sustained powerful move would be targeting the lower line of channel AC, which points to area of 1000. This channel is formed through the measured move of the top two red lines.

The yellow half circle at the bottom showed cycles of SPX index. Each 7-8 months, the SPX seemed to form a pivot low. The next pivot low is expected to be reached by end of October.

The yellow half circle at the bottom showed cycles of SPX index. Each 7-8 months, the SPX seemed to form a pivot low. The next pivot low is expected to be reached by end of October.

Within channel AB, SPX index finished a five wave upward move and now is in a correction wave down. Within the wave, a lower order five wave is in the process of forming. The rebound currently is possible the part of wave (4) formation. If that turned out to be the case, a wave (5) move down is expected soon.

Wednesday, June 15, 2011

FTSE may lead SPX lower

Watch FTSE for leading signals. It is gaining momentum to break the upward trend line. SPX may follow later.

Oil also abruptly got sold off today, testing the 200 day MA. If goes below, all risk assets sale signal will be trigered.

USD rallied against all majors today. Especially the rally against JPY in the face of dropping rates signals that the market is extremly nervous on the Greece debt roll over issue. 2yr Treasury registered a dead cross, more downward movement is expected.

Oil also abruptly got sold off today, testing the 200 day MA. If goes below, all risk assets sale signal will be trigered.

USD rallied against all majors today. Especially the rally against JPY in the face of dropping rates signals that the market is extremly nervous on the Greece debt roll over issue. 2yr Treasury registered a dead cross, more downward movement is expected.

Tuesday, June 7, 2011

SPX may be heading down below 1200

If you bought SPX at the bottom of 666 in March 2009, you have already more than double your money as it made a pivot high of 1371 in May 2011. My intuition tells me that you should sale, it happens that the market confirms in the same way. Below is a long term chart of S&P with an internal trend line drawn connecting the bottom of 2002 and the pivot high of 2010. It briefly climbed above the trend line for a couple of months, and now it is on the edge of breaking down below that line. Given the significance of the line, a break below it may trigger massive selling from the market.

Moreover, there is a clear channel within which SPX trade since 2008, except for the period of selling climax in early 2009. This channel has been successful in forecasting the pivot top made in Feb 2011. Please see my post here. If S&P decisively breaks down the internal trend line mentioned above, the target for the downward movement may be the lower line of the channel in chart below. This points to somewhere slightly below 1200.

JPY and AUD/JPY is moving towards a critical break point as well. Given the sluggish power that bull of risk assets was able to maintain during the past month and that oil may already have topped. Risk assets seem to agree with each other on the direction to the south. 10 year Treasury is unable to stay above 3.20%, a critical technical level I've been watching. 2s10s flattened significantly in the past month or so and 10s30s steepened sharply in the past weeks, both indicate that risk is off.

Thursday, February 10, 2011

US equity may have reached a short term top

US equity market may have hit a top in my opinion.

Dow Jones index closed right at the critical resistance level last week on weekly chart. It also ends its seven days concecutive rally today.

Equally important, S&P index is trading towards the upper end of the rising channel. The resistance level is between 1320-1330.

More importantly, USD rallied against all majors in the past couple of days. Especially that AUD/USD stopped getting bid in Asian sessions and steadily traded in a downward trend. Typical risk aversion mode in the capital market.

With that being said, I believe that US equity may have topped out in the short term. I am looking for a retracement of 4-5%.

Dow Jones index closed right at the critical resistance level last week on weekly chart. It also ends its seven days concecutive rally today.

More importantly, USD rallied against all majors in the past couple of days. Especially that AUD/USD stopped getting bid in Asian sessions and steadily traded in a downward trend. Typical risk aversion mode in the capital market.

With that being said, I believe that US equity may have topped out in the short term. I am looking for a retracement of 4-5%.

Tuesday, September 14, 2010

Pivot point and trading strategy for SPX

SPX index has been trading in a wide range from 1040 to 1130 in the past couple of months. Currently, it is testing the high bound again. What's next then, make or break? It is not easy to determine the direction until the market tells you so. The market sentiment definitely has changed from bearish to bullish, the pattern of the SPX also has shifted to a more bullish side than a month ago. Based on my observation, the market is likely to register non-moderate gains in six months. However, the chance of break above from current level is unknown, it is at a very critical pivot point.

Even though, the direction is unknown, a carefully planned strategy can minimize risk and maximize return potentials. Since September, SPX has rallied 5.7%, the chance of a correction is getting increasingly higher, given the historical poor performance of Sep and Oct. Moreover, rates market reaction today may implicate a top for the equity. That being said, I would hold the short position and get out at lower levels. And I would cover all my shorts if SPX close above 1150. I would also buy at 1040 if SPX drop to that level again and cover the long if it close below 1035. From there, I would look for opportunities to buy SPX at levels between 950 and 1000.

Tuesday, September 7, 2010

Unusually uncertainty of the U.S. equity market

I was out for vacation in the past week. The market seems to be more choppy than I thought, when you think things are so certain, the unexpected happens. The market is always right, no matter how confident you are about your view. The U.S. equity market is in an unusually uncertain period, I suggest we lighten up our position and wait for clear signals.

I am still bearish biased, however, the past week's rally loosen such view to some extend. I expect the equity to pull back in the short term, whether it can be a sustained move still remains to be seem. There are couple of signals I'd like to share with you on catching the next move.

VIX hit the lower bound of Bollinger band and bounced back today. Based on the previous pull back pattern, the minimum target is the mid line, with higher band as the next target. SPX index's CCI is in overbought range, only if SPX index decides to make a big upward move will the CCI stay overbought. With September being the worst month of performance of the year, I doubt the equity can make any sustained upward trending. However, to be fully convinced that bears has won the batter, I need to see the horizontal line in the chart taken out. It is the Feb low and get tested so many times, a break of this level (1040) on a closing basis will guide the next leg lower.

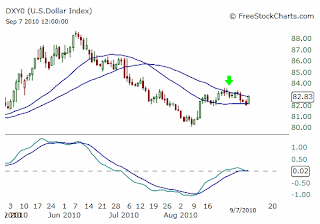

Dollar is a barometer for risk on/off trade. It has been consolidating between the 30 day and 50 day MA during the past month. I believe a sustained break on either side would give clear signal on U.S. equity market. I need to see the Aug high of 83.5 taken out before I can turn fully bearish on stocks.

Saturday, August 28, 2010

Bears, no worry

It was an extremely volatile Friday for traders, a very typical big event day. Opened up, broke down and went back up with full forces, what a day! The critical 1040 still holds, bears aren't you worried? In my view, the big downtrend has just begun to unfold, there can be bounce down the road but would be limited.

Did you notice when last time SPX index was at current level? Last September as shown in chart 1 above. For almost a year, SPX has done nothing. I plotted two arrows in the chart to show you the volume at price as well. We have broke down both of the congested areas, most people investing since last fall are losing money, therefore any rebound towards such levels should be met with significant supply. I perceive Friday's rally as just a gap filling on the daily chart, the upside potential is very limited.

The second panel in the second chart shows the breadth of the market. It is very clear that the advance volume is tipping into 'recession'. Mean while, it has been 15 consecutive weeks that money flow out of equity. Financials and technologies accounted for 35% of the total market value, they usually leads the market higher in a healthy bull market. However, what I see in the chart is that both the financials and technologies are showing very weak relative strengths to SPX index. I don't think the market can hold up without the participation of such two important sectors.

From an intermarket relationship. USD/CAD has broken out of a long time consolidating triangle. The pullback towards the triangle will be met with decent demand for it to make sustained move in the near future. This is very bearish for equity, US and global.

Thursday, August 26, 2010

SPX index with big trouble down the road

On July 18 when SPX index was around 1065, I forecasted that it will move to 1120 level based on the wave counts. The original post can be found here.

Then on Aug 5th, after SPX index hit my target of 1120 level, I called the top reversal based on complicated Elliot wave formation and intermarket relationships between US equity and USD/CAD. The original post can be found here.

Again on Aug 19th, I opined on another post that SPX index will fail to move above the 50 day MA, based on candlesticks formation and some other indicators. The original post can be found here. In that post I also pointed out the most critical support level SPX index need to penetrate in order for the coming big drop to take hold.

Today, we have it. SPX broke down the cement support level (1060-1075) and backed up to test it but failed! Now we are below the support line and quietly approaching the internal trend line highlighted in yellow. Once this line breaks, SPX index is likely to unfold a massive continued downside movement.

Revisit on the 2s10s curve trade

Some readers send me comments on the relative value trade I posted yesterday. One of them opine that the 20+ year is a better bet. However, I disagree. 2s10s and 10s30s are driven by different fundamentals and their move can vary quite a bit. I believe the belly of the curve is the prime area to put on a flattening trade. The Fed on hold scenario has been priced in by the market, and it extends along the curve from in to out . Meanwhile, the purchases of Treasury from the payoffs of MBS and agencies are concentrated on the 5-10 sectors. Therefore, we need to pick this most juicy part of the curve.

Another reader ask me about the size of the trade, which is a great point worth mentioning. On a pure curve trade, the position should be duration neutral. In other words, the dollar duration of 2s and 10s of the trade needs to be the same. 2s duration is around 1.9, 10s duration is around 8 at current yield. Given that IEF's bond investments are in the 7-10 year sectors, the duration of it should be somewhere between 6-8. Today's market value of SHY and IEF are 84 and 99, respectively. So the unit ratio is approximately 4.4. In other words, you need to short 4.4 units of SHY for each unit long in IEF. When rate changes, the ratio will change as well due to the convexity of fixed income instruments. However, that won't be too big of a problem, the dollar duration match should get you the bulk part of trade idea.

A step further is to express views on both the curve and the rates. My view is that the 10s rates can tank further to 2% level. For this bull flattening trade, you can long one unit of IEF and short less than 4.4 units of SHY, depending on your risk appetite. The less risk averse you are, the further away from 4.4 units you should be shorting. However, no matter what, remember to adjust the ratio back to approximately 4.4 after we get clear signal that rates have hit the bottom.

Wednesday, August 25, 2010

One guaranteed relative value trade

It is hard to make a sure winning trade in this unusually uncertain economy. However, there is one trade I perceive as a high confidence level trade. If you are conservative in nature and don't want to take equity market risk -- long or short, or you are too busy and don't have the time to take care of your investment portfolios, then this trade should work in your favour over the long term.

The above chart shows the 2s10s curve, which is the spread between 10 year Treasury yield and 2 year Treasury yield. 2s10s Treasury yield curve is a barometer of the economy, it peaks and troughs with each business cycle. In the current cycle, it topped out at 290 level in the beginning of 2010. Since then, it trended down to the trend line and broke it decisively later on. I believe this curve will tightened more in the near future. 2 year yield is around 50bps, even with Fed on hold, the room for downside is very limited. However, 10 year yield is at 2.50%, with the possible downward revision to GDP growth, subdued core inflation and the speed of flight to safety, it can shoot for 2.00% or even lower. This alone will flatten the curve massively. Meanwhile, when the Fed decide to hike, it will act in a very aggressive fashion, given how much liquidity it punch into the system. This will lift the front end of the curve abruptly, which is beneficial to our flattening trade.

The initial target comes in at 173bps, the 38.2% Fibonacci retracement, then at 136bps, the 50% Fibonacci retracement and then at 99bps, the 61.8% Fibonacci retracement.

For retail investors to take position based on the view expressed above, you can short SHY (1-3 year Treasury bond) and long IEF (7-10 year Treasury bond). SHY is the orange line in the chart and IEF is the white line. Hold it for some period of time, you will see your account goes up faster than GDP growth, and that's for sure with little attention.

Tuesday, August 24, 2010

Investing in ETF

I have been trading ETFs since they their inception. I found them to be very helpful in enhancing investment performance. Compared to mutual fund, they are more liquid, transparent and less costly in fee & expense structures. If you don't want to take individual stock risks but want to gain exposure to the broad market, then ETF is an ideal instrument for you.

since they their inception. I found them to be very helpful in enhancing investment performance. Compared to mutual fund, they are more liquid, transparent and less costly in fee & expense structures. If you don't want to take individual stock risks but want to gain exposure to the broad market, then ETF is an ideal instrument for you.

I use top down approach in trading ETFs. First, I use technical analysis to identify the trend of the broad market, so that I can determine whether I shall go long or short; then, I scan for the most relative strength or weakness subjects compared to the major indexes; then based on my risk appetite and view confidence. I selects the ETFs with the appropriate leverage to add to my portfolio. Quite often, my strategy involves combining various ETFs to maximize my return/risk profile. Complicated option strategies are used either as a hedge or an outright position taking. The timing of entry and exit is critical, especially with leveraged portfolios.

For the convenience of my reader, I am compiling some of the most liquid and widely traded ETFs below.

x1 Bull: DIA (Dow), SPY (S&P500), QQQQ (Nasdaq 100), IWM (Russel 2000), EEM (Emerging market), XLF (Financial), KRE (Regional banking), XLE (Energy), IYR (Real Estate),XHB (Home builder), SMH (Semi conductor), RTH (Retail), IBB (Nasdaq biotech), OIH (Oil services) FXI (China), EWH (Hongkong), EWT (Taiwan), EWZ (Brazil), EWJ (Japan), VXX (VIX), IVW (S&P growth)

x2 Bull: DDM (Dow), SSO (S&P 500), QLD (Nasdaq 100), UYG (Financial), URE (Real estate), DIG (Oil and gas), UYM (Basic material)

x3 Bull: BGU (Large cap), TNA (Small cap), FAS (Financial), ERX (Energy), CZM (China), EDC (Emerging market)

x2 Bear: DXD (Dow), SDS (S&P 500), QID (Nasdaq 100), TWM (Russel 2000), SKF (financial), SRS (Real estate), TBT (20yr+ Treasury), FXP (China), EEV (Emerging market)

x3 Bear: BGZ (Dow), SPXU (S&P 500), FAZ (Financial), TZA ( Small cap), CZI (China), EDZ (Emerging market)

Metals: XME (Metal and mining), GLD (Gold), UGL (Gold x2), GDX (Gold miner) SLV (Silver), SLX (Steel)

Monday, August 23, 2010

Essential readings I recommend for trading

Some readers asked my advice on choosing books for trading. Therefore, this post is dedicated to commenting on some master piece that I highly recommend.

John Murphy's Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications (New York Institute of Finance) is the essential reading for beginners. As the bible of technical analysis, it educates traders on stocks and futures trading. It not only includes crucial topics on traditional trend analysis and pattern recognitions, but also features new material on candlestick charting, inter market relationships, stocks and stock rotation.

is the essential reading for beginners. As the bible of technical analysis, it educates traders on stocks and futures trading. It not only includes crucial topics on traditional trend analysis and pattern recognitions, but also features new material on candlestick charting, inter market relationships, stocks and stock rotation.

Charles D. Kirkpatrick II 's Technical Analysis: The Complete Resource for Financial Market Technicians is a superb book for intermediate or advanced level traders. Charles Kirkpatrick II, CMT, the author, a Wharton graduated professor have decades of experience in using and teaching technical analysis on the college level. There are extensive statistics on trading patterns included in this book. This books has all the technical analysis information you need, on top of that it also extends to cover topics on cycles, Elliott wave, Fibonacci and Gann. system design and testing, and money management.

is a superb book for intermediate or advanced level traders. Charles Kirkpatrick II, CMT, the author, a Wharton graduated professor have decades of experience in using and teaching technical analysis on the college level. There are extensive statistics on trading patterns included in this book. This books has all the technical analysis information you need, on top of that it also extends to cover topics on cycles, Elliott wave, Fibonacci and Gann. system design and testing, and money management.

Steve Nison's Japanese Candlestick Charting Techniques, Second Edition provides in-depth candlesticks analysis in a very easy to understand English. It covers all the candlesticks patterns you need to know for trading. Japanese has been using candlesticks on rice trading centuries ago, and things exist for a reason. I found that by using candlesticks techniques in my trading system, I can identify trend reversals in a much more timely manner. Western technical analysis system is a must have for traders, however, with the help of candlesticks it can immediate boost your skillset up 3 levels.

provides in-depth candlesticks analysis in a very easy to understand English. It covers all the candlesticks patterns you need to know for trading. Japanese has been using candlesticks on rice trading centuries ago, and things exist for a reason. I found that by using candlesticks techniques in my trading system, I can identify trend reversals in a much more timely manner. Western technical analysis system is a must have for traders, however, with the help of candlesticks it can immediate boost your skillset up 3 levels.

Alexander Elder's Trading for a Living: Psychology, Trading Tactics, Money Management is based on three M’s: Mind, Method, and Money. As a phsyciatrist, Elder explains technical terms in a very vivid and humorous way. With his lively explanation of the hard to understand technical terminologies, you can grab the concepts much easier. I have to admit that Elder's wirting is music to my ear.

is based on three M’s: Mind, Method, and Money. As a phsyciatrist, Elder explains technical terms in a very vivid and humorous way. With his lively explanation of the hard to understand technical terminologies, you can grab the concepts much easier. I have to admit that Elder's wirting is music to my ear.

Alexander Elder's Come Into My Trading Room: A Complete Guide to Trading takes you far beyond the three M’s This essential book educates the novice and gives more power to the professional through expert advice, proven trading methods, and something entirely unique–a visit to Dr. Elder’s own trading room. "Trading is the most exciting activity that a person can do with their clothes on. Trouble is, you cannot feel excited and make money at the same time." A cool mind is crucial for anyone who want to be successful in the market, and this book is the one that help you achieve it.

takes you far beyond the three M’s This essential book educates the novice and gives more power to the professional through expert advice, proven trading methods, and something entirely unique–a visit to Dr. Elder’s own trading room. "Trading is the most exciting activity that a person can do with their clothes on. Trouble is, you cannot feel excited and make money at the same time." A cool mind is crucial for anyone who want to be successful in the market, and this book is the one that help you achieve it.

Mislenious newsletters and trading systems. Knowledge needs to be connected with practice. All the above books will provide you enough concepts and tools for analysis. Meanwhile, you need to have real marekt updates and trading systems to provide foods for thinking and help develop your own system. Most of the newletters, strategies and trading systems on the corner of my blog have free trial period, just try, they are free.

I have more than 50 trading books in my room and everyone of them is unique. I shared with you the best of the best in above and put the books on the left hand side for your convinience. They are must read for traders, beginner or advanced.

Sectors relative strength

The chart on the left above is the relative strength of financial stocks to the overall market. In another words, it is the ratio of financial sector ETF to the SPX index. It has been trending down since Apr, i.e. financial stocks drop in a faster fashion than the broad index. Usually, the financial sector leads the market up in a bull market. Obviously, money is leaving this sector and that doesn't bode well for the overall market health.

The chart on the right above is the relative strength of utility sector to the overall market. This is a defensive sector, when fund managers are not optimistic on the equity market, they tend to allocate more money into the high dividend paying sectors, like utility, health and staple sectors. The current money flow trend indicates that fund managers are in defensive mode.

The above chart is the relative strength of large caps to small caps. Large caps usually are high and stable dividend companies. Small caps most often are growth and high risk companies. In a risk taking mode, small caps outperforms large caps. However, that is not the case now, the market is in a risk off mode.

Subscribe to:

Posts (Atom)