I was out for vacation in the past week. The market seems to be more choppy than I thought, when you think things are so certain, the unexpected happens. The market is always right, no matter how confident you are about your view. The U.S. equity market is in an unusually uncertain period, I suggest we lighten up our position and wait for clear signals.

I am still bearish biased, however, the past week's rally loosen such view to some extend. I expect the equity to pull back in the short term, whether it can be a sustained move still remains to be seem. There are couple of signals I'd like to share with you on catching the next move.

VIX hit the lower bound of Bollinger band and bounced back today. Based on the previous pull back pattern, the minimum target is the mid line, with higher band as the next target. SPX index's CCI is in overbought range, only if SPX index decides to make a big upward move will the CCI stay overbought. With September being the worst month of performance of the year, I doubt the equity can make any sustained upward trending. However, to be fully convinced that bears has won the batter, I need to see the horizontal line in the chart taken out. It is the Feb low and get tested so many times, a break of this level (1040) on a closing basis will guide the next leg lower.

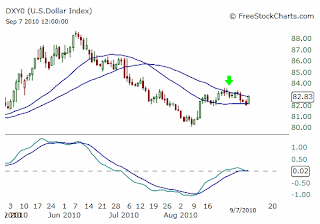

Dollar is a barometer for risk on/off trade. It has been consolidating between the 30 day and 50 day MA during the past month. I believe a sustained break on either side would give clear signal on U.S. equity market. I need to see the Aug high of 83.5 taken out before I can turn fully bearish on stocks.

1 comment:

i think the mkt will keep an upward trend till spx hit 1125 (previous high). from the past 2 wks, we see ppl r eager to buy @ 1040 region, ignorant of the bad news. when positive news comes out, mkt usually opens with gap up. there might be a re-shuffle of the mkt to bring down some over sold pressure, but it will come back. given that sept is bloody historically, i think the mkt will reflect the real economy in the later period, especially after the midterm election.

Post a Comment